Evolution, Inc. since 1979

Insurance premium finance for insurance agents

Why finance? Financing insurance premiums is well known. However, let's not forget the insurance agent is the point of sale, the agent paid all expenses to get the insurance premium financed yet didn't get any of the profit thus losing 100% of the potential profit. The gold mine you are sitting on is not producing, start mining!

The agent already knows that if they can't close / sell the insurance policy because the policyholder doesn't have enough to pay for it and the policyholder walks. Everyone loses the policyholder with no coverage and the agent loses insurance policy commission.

Solution: Create the ability to make decisions about your own finance company with your own terms and profit. Did I mention, your customer base, your business, your profit does not need to go out the door. This also helps in a hard market.

Finance in-house or outsource the work?

Decision time, but first you should evaluate what would work for you. Don't be to hasty in making this decision or let some fast talking salesperson convince you one way or the other.

Most want to earn the most money and compare what the workload would be. As you read we tried to show both methods. If you find we didn't cover something, email us and set us straight.

Captive premium finance companies

First I dislike the word "captive" to me it's something I would never want to happen to me. Thus, why is the word used? However, we will go along with the terminology.

This would be a insurance premium finance company as an agent would own.

We refer to this a captive premium finance operation as one where you the premium finance company owner runs and operates the business.

Now you have the choice to make, license software to run the business or enter into an agreement for a third party to do daily processing.

Out Sourcing Your Premium Finance Daily Operations

The agency personnel will process financed premiums just as they do with outside finance companies. No need to train their staff or manage the daily operations.

In short with outsourcing to Evolution Inc., the agent

creates a new profit center with increased earnings.

return on investment (ROI) in the 25% to 40% range which is influenced by interest rates, size of premium , cancellations, etc.

can keep control of their customer base by setting up your own payment parameters

does not have to be concerned about running a premium finance company.

will have Evolution Inc., decades in business, to do all the Back Office daily processing while keeping agency owners in the loop at all times including, 24/7 with Accounts .Net™ real time internet access functions. You will rapidly see increased profits without the hassle.

can decide at any time to bring in back in-house where the agency staff would take over Back Office+™ daily operations by licensing Evolution's software. Contrary to some beliefs, it takes very little effort to do finance your own premiums in-house. Evolution can tell you why!

Evolution naturally, after decades leading the insurance premium industry has the ability for you to outsource your premium finance company operations to Evolution. We have all the industry standard out sourcing agreements and skills and software (naturally) to do so and remote tools for you to monitor as you see fit. Go figure.

There are some premium finance outsourcing advantages like; overhead expenses, staffing concerns, no equipments is needed, variable costs processing fee based upon volume, and Evolution brings our software vendor expertise as well as the technology for your policyholders and agents (if you finance multiple agents). Consult with us to see if outsourcing premium financing is the right choice for you.

Beware, some like to try to convince, sell or scare you enough into outsourcing is the only way to do premium finance. Make you worry about audits, state laws, interest calculation or late fees or any other aspects of financing premium they can get you to buy into.

Stop! Except for state audits, Evolution's software already handles the "so called problems" in business rules within the software. Been doing it for decades. With our software state audits are no problem, we have the tools in the software to satisfy auditors, we always have.

Makes sense that they want you to do it their way, after all that is how they make money.

Spend it or keep it to reinvest, Evolution will give facts, show you the simplicity of daily operations then the decision is yours. Of course, if Evolution does your processing the we will handle state audits.

Outsourcing, what do you lose?

Control, you are doing the hardest part of the whole process, booking the premium finance contract. It's their rates and their rules.

Potential new insurance sales because now they call some one else, when it can be you when they want to find out about their payment. Me I would want every opportunity to talk to my policyholders. Keep them close.

Lost revenues which amount to about 1/3 of your profit. Establishing your own premium finance company allows you grow your profits by 50% or more.

In house premium financing makes agency bill an additional profit center. If you have a 30 or 45 day float your yield will go up dramatically. Why give that away too!

Contact Evolution and have them run your production numbers to see really how much money you are giving away when it is so easy to do it yourself. You have more to gain than lose and it cost nothing to look.

In house premium financing, what do you gain?

Who do you think is going to take better care of your customers?

Remember you are the point of sale, these are your customers, your x-dates, your profit!

Fact: a lot of states do not require an agent to get a premium finance license if you finance your own policies. Not sure, call Evolution Inc and we will advise you.

Control, you set you own rate plans. Your rates and your rules.

No need to forward premium finance agreement to the premium finance company.

Handling of the down payment just got easier.

MONEY, but you have to quit giving your business away and take control, it is not that hard. Evolution defies anyone else who can prove your investment is better served elsewhere. Call and we will show you in black and white based upon our 43+ years in the insurance premium industry. You kick the numbers around we send you. You will be quite surprised about how easy it is to do and the amount of money you can make!

Where else can you earn 21% on your money? What is the percentage of insurance policy commission do you make? 21% vs ____%, what are you waiting for?

This additional revenue allow for growth, increased staff devoted to sales or x-dating. There are lots of ideas.

Personalized service for your customers / policyholders.

Evaluating Vendors

So you decide after all to outsource your premium finance operations.

Outsourcing via Evolution is a better decision than with other companies who don't develop their own software. Creditability earned, never given. Saying Evolution is not good enough to service your loans after 43 years of developing software specifically to run premium finance companies is like saying we don't know the words to our own song.

Another big advantage with Evolution is that at any time you decide to do it yourself, no problem, that data is yours and we will help you get it installed on your own computer or a server farm near you.

However, once you see how easy it is to do daily operations you probably will decide to do it yourself. Why give up some of your profit? Not to say that we don't have a problem earning more money, so bring it.

Premium Finance Software

Insurance agents there is an industry that is available to you that would generate returns far in excess of almost anything that you are currently doing or invested in. Most insurance agents already know about it. If you don't it is a high yield investment.

In-house vs. Outsourcing premium finance. The difference between doing it in house (existing staff) or outsourcing is profit. Once people see how simple Evolution made daily processes, they quickly realise doing it themselves is the correct decision. Control and profit, after all isn't that the way you do business now. See profit calculator below.

If you are an insurance agent, “You're sitting on a gold mine”? Well this expression applies to you if you’re not currently financing your own premiums. Your Gold Mine - By now most of you have already seen your production numbers in our profit calculator spreadsheet. If not call us @ 913-384-2654, takes about 10 minutes.

Evolution will show you how easy it is to start your own premium finance company.

We will show you how to leverage your own capital by financing your own policies. Many agencies have higher profit margins on the finance side than they do on the agency side. This could be you too!!

21% APR + setup & late fees vs.  Low money market rates,

Low money market rates,

Soft insurance market, or lousy returns on stock market investments.

Take control now! Earn more NOW!!

We can show you how simple it is to get started.

Quick and easy bullets:

- Earn around 21% APR for personal lines + setup and late fees. Set your own rates for commercial lines premium. All based upon 9 payments.

- Use your existing cash to finance. Increase available cash with investment notes or leverage at your local bank.

- Create Investment Notes with friends and family; borrow at 4-10%, loan at 21%.

- Banks historically leverage 80-90% of insurance premium finance receivables. After a year in business leverage your cash with a bank.

- You'll make full profit (i.e. 21% + fees) on your cash

- Then partial profit (i.e. 21% - xx% bank loan rate + fees) from your cash level to your credit line limit.

- We can help provide your bank information.

- Premium finance software is now extremely affordable.

- Many states allow agents / banks and insurance companies to finance their own policies without a license.

- Most are in the black within 3 to 9 months.

- What are you waiting for?? Profit hardly gets any better than credit card rates.

- Fully collateralized loans. Exceptions: Fully earned or audited premiums.

- Low average mark off of ½ of 1%.

- Easy exit strategy if you decide to quit.

- Read on to find out how all this works.

The premium finance business is a healthy and robust industry and agents give it away to others, at a rate of about $156 million dollars a day.

Until now, premium finance software has been too expensive for some to get in the game.

Insurance agents are the backbone of one of the largest industries in the world, insurance. Agents (including general agents) have been making premium finance companies rich for many years. Agents, including general agents are the sole source for premium financing. Agents are the single most important element of the premium finance industry, so much so that companies fight for their allegiance, yet they pay a pittance to what you can really make.

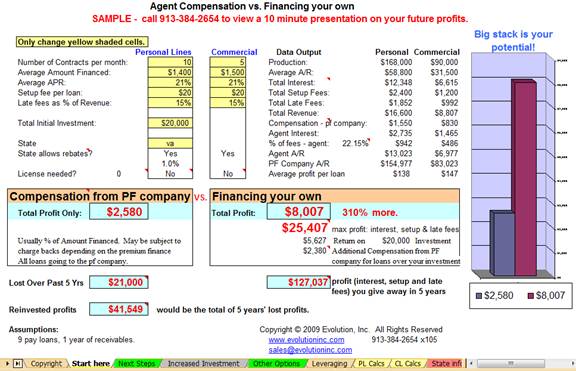

Potential profit calculator for premium finance

As you review the picture below you will see that we are serious about you being able to see how much money you are giving away if you send your premium finance to others.

Notice the cells in yellow. Call us with your numbers. We will connect up online and show you how much profit is sliding through your fingers on business that you own and worked hard to get.

- We will show you premium finance profit compared to other investments

- What if you leverage your money

- Single loan calculations for both personal lines and commercial line insurance policies

- Use your state calculations

- Want to increase your investment profit? Call today 913-384-2654

Premium Finance startling facts

All comparative measurements and benchmarks are based upon analysis of hundreds of premium finance companies over a ten-year time span.

- The industry finances about $40 billion in premium finance per year (way back in 2003). That is about $156 Million dollars per working day.

- How much of this is yours or agents you know?

- National and regional premium finance companies, in terms of sources of business, are not community based.

- The typical premium finance company retains 20% of its income. Performance in the 20-25% range is considered above average, 25-30% is considered good. Performance in the 30-40% range is considered excellent.

- PF companies typically return 25% to 40% on invested capital.

- If you are an agent and have a float, it will increase your yield.

- Banks engaged in lending to the premium finance industry typically start out at an 80% Rate of Advance (4.0:1) and will gradually move the customer to a 90% Rate of Advance (9.0:1).

- The mark off of uncollectible balances is negligible. The benchmark number for commercial premium finance companies is ½ to 1% of receivables, with the larger companies (>$100 Million) closer to ½% and the smaller companies closer to 1%.

- Premium finance companies can write nonstandard auto business at state maximum rates (about in the range of 20-40%).

- PF companies prefer not to use ACH for insured’s payments because there is too much money lost in late fees if most payments are received on time.

Why should you do premium finance?

If you want to enter the premium finance market you must be willing to look at facts before making any decision. These loans are made without doing any credit checks on the borrowers because the loans are fully secured by the unearned portion of the premium. Premium finance companies never get social security numbers and have done tens of billions of dollars in loans. Every business day, $156 Million dollars in loans with an industry average mark off of ½ of 1% of accounts receivables is transacted.

SunTrust Bank (Premium Assignment Corp PAC) and BB&T  (Prime Rate), Wells Fargo, Webster Bank, MetaBank, to name a few, finance billions of dollars of insurance premiums by themselves. read more... Why so you think these banks do it? Could it be credit card type profit returns on secured loans that don’t require credit checks? Why can’t you?

(Prime Rate), Wells Fargo, Webster Bank, MetaBank, to name a few, finance billions of dollars of insurance premiums by themselves. read more... Why so you think these banks do it? Could it be credit card type profit returns on secured loans that don’t require credit checks? Why can’t you?

Average Mark Off

How is the industry average mark off of ½ of 1% of accounts receivable possible? Most, if not all states have laws like those listed below. It is abundantly clear that the state attorney general is more effective than any collection agency. In fact, in the last 30 years in this industry we have never heard of any premium finance company that was unable to gain satisfaction through state regulators, forcing them to appeal to the attorney general because all carriers know the law.

Return of Unearned Premium

When a financed policy is cancelled, the unearned premium, by law, must be returned to the company that financed the premium. Following are examples of state statutes requiring return of unearned premium. For space reasons all states are not listed.

Alabama

Insurance code, ch.40, Section 27-40-12

Insurer shall return gross unearned premium to finance company. Return premium must be paid to finance company within 90 days after cancellation effective date. Credit balances must be paid to insured within 30 days after receipt.

Florida

Section 627.848(6)

Insurer shall pay gross return premium to finance company. Return premium must be sent "promptly".

Illinois

Insurance dept. regulations, article xxxiii, section 521(4).

Insurer shall return gross return premium to finance company. Insurer can pay net amount in the case of assigned risk policies.

Kansas

Insurance dept. Kansas Premium Finance Act, section 40-2612(e).

Whenever a financed insurance contract is canceled, the insurer shall within 20 days of the effective date of cancellation, return whatever gross unearned premiums are due under the insurance contract to the premium finance company, either directly or via the agent of agency writing the insurance, where an assignment of such funds is included in the premium finance agreement for the account of the insured or insureds.

Michigan

Insurance laws, section 500.1511(5)

Insurer shall return gross unearned premium to finance company. Third parties must be notified on or before the third business day following receipt of the premium finance notice of cancellation.

Minnesota

Insurance code, ch.59A.12 Subd 1-3

Subdivision 1 requires pro-rata computation of return as well as gross return paid within 30 days of cancellation. Subdivision 2 requires that gross return be computed based upon the deposit premium whenever audible. Subdivision 3 requires that any credit balance be paid to insured within 30 days of receipt of the return premium from company or agent.

Missouri

Statutes, section 364.135

Insurer shall return gross unearned premium direct to finance company. It requires that return premium be paid to finance company within 60 days after cancellation

New Jersey

Dept. of banking, insurance premium financing act, ch.221, Section 14.

Insurer shall return gross unearned premium. Requires that return premium will be paid to finance company within 60 days after date of cancellation or 60 days after completion of the audit. All audits must be completed within 30 days of cancellation date.

North Carolina

Statute 58-60(5)

Insurer shall return gross unearned premium to finance company. Requires that return premium be sent direct to finance company "promptly" and credit be returned to insured "promptly".

Oregon

Dept. of Commerce Oregon statute 746.505(5)

Insurer shall return gross unearned premium to finance company.

Pennsylvania

Premium finance company act, Pennsylvania insurance laws, ch.4, Article ii, section 11 (40 p. S. Sec.3311).

Insurer shall return gross unearned premium to finance company. Requires that payment be made to premium finance company within 60 days after cancellation. Finance company must refund credit to insured within ten days of receipt from insurer.

North Carolina

North Carolina's § 58-35-85. Procedure for cancellation of insurance contract upon default; return of unearned premiums; collection of cash surrender value

(5) When an insurance contract is cancelled in accordance with this section, the insurer shall promptly return the gross unearned premiums that are due under the contract to the insurance premium finance company effecting the cancellation, for the benefit of the insured

South Carolina

Insurance regulation 69-10, paragraph 21-23.

Insurer shall return gross unearned premium. Requires that return premium be paid to finance company within 30 days after cancellation. Paragraph 23 requires that credit balances be paid to insured within 30 days after receipt from insurer.

Insurance premium finance credit line

Call today 913-384-2654 or go here to read more....