Insurance premium finance for insurance agents

Premium Finance Software

Insurance agents there is an industry that is available to you that would generate returns far in excess of almost anything that you are currently doing or invested in. Most insuaance agents already know about it. If you don't it is a high yield investment.

If you are an insurance agent, “You’re sitting on a gold mine”? Well this expression applies to you if you’re not currently financing your own premiums. You Gold Mine - By now most of you have already seen your production numbers in our profit calculator spreadsheet. If not call us @ 913-384-2654, takes about 10 minutes.

We will show you how to leverage your own capital by financing your own policies. Many agencies have higher profit margins on the finance side than they do on the agency side. This could be you too!!

21% APR + setup & late fees vs.  Soft insurance market, Low money market rates, lousy returns on stock market investments, Take control now! Earn more NOW!!

Soft insurance market, Low money market rates, lousy returns on stock market investments, Take control now! Earn more NOW!!

We can show you how simple it is to get started.

Quick and easy bullets:

- Earn around 21% APR for personal lines + setup and late fees. Set your own rates for commercial lines premium. All based upon 9 payments.

- Use your existing cash to finance. Increase available cash with investment notes or leverage at your local bank.

- Create Investment Notes with friends and family; borrow at 4-10%, loan at 21%.

- Banks historically leverage 80-90% of insurance premium finance receivables. After a year in business leverage your cash with a bank.

- You’ll make full profit (i.e. 21% + fees) on your cash

- Then partial profit (i.e. 21% - xx% bank loan rate + fees) from your cash level to your credit line limit.

- We can help provide your bank information.

- Premium finance software is now extremely affordable.

- Many states allow agents / banks and insurance companies to finance their own policies without a license.

- Most are in the black within 3 to 9 months.

- What are you waiting for?? Profit hardly gets any better than credit card rates.

- Fully collateralized loans. Exceptions: Fully earned or audited premiums.

- Low average mark off of ½ of 1%.

- Easy exit strategy if you decide to quit.

- Read on to find out how all this works.

The premium finance business is a healthy and robust industry and agents give it away to others, at a rate of about $156 million dollars a day.

Until now, premium finance software has been too expensive for some to get in the game.

Insurance agents are the backbone of one of the largest industries in the world, insurance. Agents (including general agents) have been making premium finance companies rich for many years. Agents, including general agents are the sole source for premium financing. Agents are the single most important element of the premium finance industry, so much so that companies fight for their allegiance, yet they pay a pittance to what you can really make.

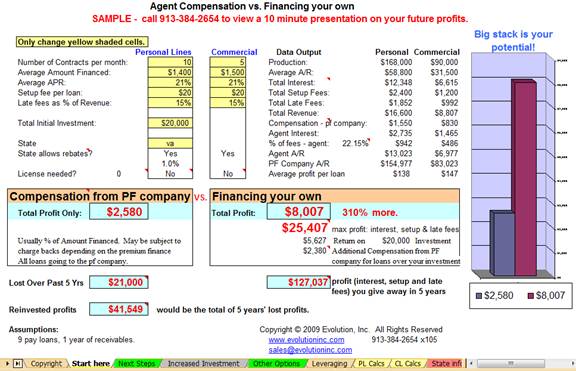

Potential profit calculator for premium finance

As you review the picture below you will see that we are serious about you being able to see how much money you are giving away if you send your premium finance to others.

Notice the cells in yellow. Call us with your numbers. We will connect up in an internet meeting and show you how much profit is sliding through your fingers on business that you own and worked hard to get.

- We will show you premium finance profit compared to other investments

- What if you leverage your money

- Single loan calculations for both personl lines and commercial line insurance policies

- Use your state calculations

- What in you increase your investment? Call today 913-384-2654

Premium Finance startling facts

All comparative measurements and benchmarks are based upon analysis of hundreds of premium finance companies over a ten-year time span.

- The industry finances about $40 billion in premium finance per year (way back in 2003). That is about $156 Million dollars per working day.

- How much of this is yours or agents you know?

- National and regional premium finance companies, in terms of sources of business, are not community based.

- The typical premium finance company retains 20% of its income. Performance in the 20-25% range is considered above average, 25-30% is considered good. Performance in the 30-40% range is considered excellent.

- PF companies typically return 25% to 40% on invested capital.

- If you are an agent and have a float, it will increase your yield.

- Banks engaged in lending to the premium finance industry typically start out at an 80% Rate of Advance (4.0:1) and will gradually move the customer to a 90% Rate of Advance (9.0:1).

- The mark off of uncollectible balances is negligible. The benchmark number for commercial premium finance companies is ½ to 1% of receivables, with the larger companies (>$100 Million) closer to ½% and the smaller companies closer to 1%.

- Premium finance companies can write nonstandard auto business at state maximum rates (about in the range of 20-40%).

- PF companies prefer not to use ACH for insured’s payments because there is too much money lost in late fees if most payments are received on time.

Why should you do premium finance?

If you want to enter the premium finance market you must be willing to look at facts before making any decision. These loans are made without doing any credit checks on the borrowers because the loans are fully secured by the unearned portion of the premium. Premium finance companies never get social security numbers and have done tens of billions of dollars in loans. Every business day, $156 Million dollars in loans with an industry average mark off of ½ of 1% of accounts receivables is transacted.

SunTrust Bank (Premium Assignment Corp PAC) and BB&T  (Prime Rate), Wells Fargo, Webster Bank, MetaBank, to name a few, finance billions of dollars of insurance premiums by themselves. read more... Why so you think these banks do it? Could it be credit card type profit returns on secured loans that don’t require credit checks? Why can’t you?

(Prime Rate), Wells Fargo, Webster Bank, MetaBank, to name a few, finance billions of dollars of insurance premiums by themselves. read more... Why so you think these banks do it? Could it be credit card type profit returns on secured loans that don’t require credit checks? Why can’t you?

Average Mark Off

How is the industry average mark off of ½ of 1% of accounts receivable possible? Most, if not all states have laws like those listed below. It is abundantly clear that the state attorney general is more effective than any collection agency. In fact, in the last 30 years in this industry we have never heard of any premium finance company that was unable to gain satisfaction through state regulators, forcing them to appeal to the attorney general because all carriers know the law.

Return of Unearned Premium

When a financed policy is cancelled, the unearned premium, by law, must be returned to the company that financed the premium. Following are examples of state statutes requiring return of unearned premium. For space reasons all states are not listed.

Alabama

Insurance code, ch.40, Section 27-40-12

Insurer shall return gross unearned premium to finance company. Return premium must be paid to finance company within 90 days after cancellation effective date. Credit balances must be paid to insured within 30 days after receipt.

Florida

Section 627.848(6)

Insurer shall pay gross return premium to finance company. Return premium must be sent "promptly".

Illinois

Insurance dept. regulations, article xxxiii, section 521(4).

Insurer shall return gross return premium to finance company. Insurer can pay net amount in the case of assigned risk policies.

Kansas

Insurance dept. Kansas Premium Finance Act, section 40-2612(e).

Whenever a financed insurance contract is canceled, the insurer shall within 20 days of the effective date of cancellation, return whatever gross unearned premiums are due under the insurance contract to the premium finance company, either directly or via the agent of agency writing the insurance, where an assignment of such funds is included in the premium finance agreement for the account of the insured or insureds.

Michigan

Insurance laws, section 500.1511(5)

Insurer shall return gross unearned premium to finance company. Third parties must be notified on or before the third business day following receipt of the premium finance notice of cancellation.

Minnesota

Insurance code, ch.59A.12 Subd 1-3

Subdivision 1 requires pro-rata computation of return as well as gross return paid within 30 days of cancellation. Subdivision 2 requires that gross return be computed based upon the deposit premium whenever audible. Subdivision 3 requires that any credit balance be paid to insured within 30 days of receipt of the return premium from company or agent.

Missouri

Statutes, section 364.135

Insurer shall return gross unearned premium direct to finance company. It requires that return premium be paid to finance company within 60 days after cancellation

New Jersey

Dept. of banking, insurance premium financing act, ch.221, Section 14.

Insurer shall return gross unearned premium. Requires that return premium will be paid to finance company within 60 days after date of cancellation or 60 days after completion of the audit. All audits must be completed within 30 days of cancellation date.

North Carolina

Statute 58-60(5)

Insurer shall return gross unearned premium to finance company. Requires that return premium be sent direct to finance company "promptly" and credit be returned to insured "promptly".

Oregon

Dept. of Commerce Oregon statute 746.505(5)

Insurer shall return gross unearned premium to finance company.

Pennsylvania

Premium finance company act, Pennsylvania insurance laws, ch.4, Article ii, section 11 (40 p. S. Sec.3311).

Insurer shall return gross unearned premium to finance company. Requires that payment be made to premium finance company within 60 days after cancellation. Finance company must refund credit to insured within ten days of receipt from insurer.

North Carolina

North Carolina's § 58-35-85. Procedure for cancellation of insurance contract upon default; return of unearned premiums; collection of cash surrender value

(5) When an insurance contract is cancelled in accordance with this section, the insurer shall promptly return the gross unearned premiums that are due under the contract to the insurance premium finance company effecting the cancellation, for the benefit of the insured

South Carolina

Insurance regulation 69-10, paragraph 21-23.

Insurer shall return gross unearned premium. Requires that return premium be paid to finance company within 30 days after cancellation. Paragraph 23 requires that credit balances be paid to insured within 30 days after receipt from insurer.

Insurance premium finance credit line

Call today 913-384-2654 or go here.